Table of Contents

Securing funding for your small business can be a pivotal step towards growth and success. Entrepreneurs must follow a strategic approach to navigate the complex landscape of small business loans successfully. This comprehensive guide outlines essential steps, from initial preparations to post-application actions, ensuring a smooth and informed loan application process.

What Are the Initial Preparations Required Before Applying for a Small Business Loans?

Before diving into the loan application process, entrepreneurs must thoroughly evaluate their business’s financial health. Assess your financial standing, review credit reports, and address outstanding issues. Ensure that your business records, including financial statements and tax returns, are up-to-date and accurately reflect your company’s performance.

How Can Entrepreneurs Assess and Determine Their Exact Funding Needs?

Precise financial planning is crucial in determining the exact funding required. Evaluate upcoming projects, operational expenses, and potential growth opportunities. Create a detailed budget that considers all aspects of your business, allowing you to approach lenders with a clear understanding of your financial needs.

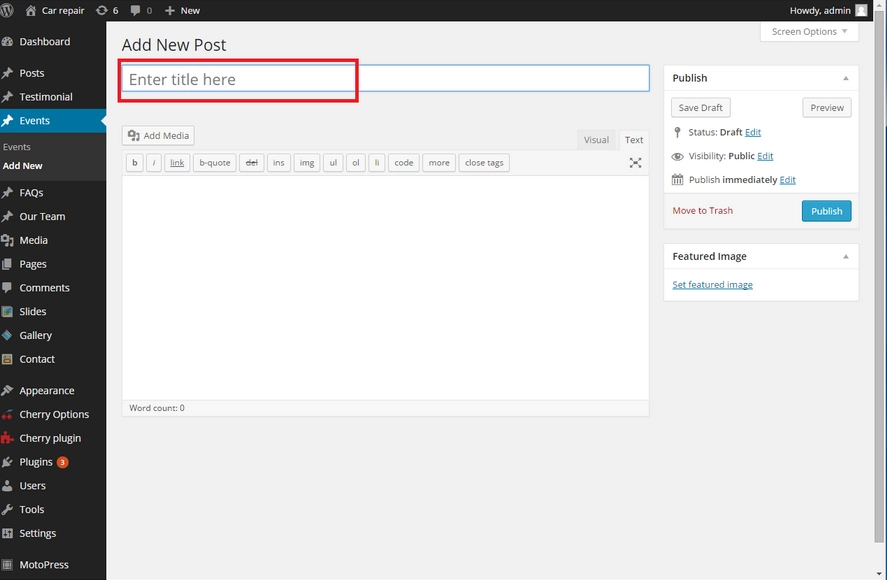

What Documentation Is Essential for a Smooth Small Business Loans Application Process?

Lenders require specific documentation to evaluate the risk of lending to your business. Prepare financial statements, tax returns, business plans, and other relevant documents the lender requests. A well-organized and comprehensive application package increases your chances of loan approval.

How Do Entrepreneurs Choose the Right Type of Small Business Loans for Their Needs?

Understanding the various types of small business loans is crucial. Consider factors such as the purpose of the loan, repayment terms, and interest rates. Whether it’s a term loan, SBA loan, or line of credit, selecting the right fit for your business ensures optimal financial support.

What Factors Do Lenders Consider When Reviewing Small Business Loans Applications?

Lenders assess several factors when reviewing loan applications. These include credit history, cash flow, collateral, and business viability. Presenting a strong case in each area enhances your loan approval chances.

How Can Entrepreneurs Improve Their Credit Score Before Applying for a Loan?

A positive credit score is instrumental in securing favourable loan terms. Prioritize paying off existing debts, rectifying errors on your credit report, and establishing a consistent payment history. A higher credit score demonstrates financial responsibility to lenders.

What Strategies Can Business Owners Use to Strengthen Their Loan Application?

Craft a compelling business plan that outlines your business’s mission, goals, and strategies. Highlight your industry expertise, market research, and competitive advantage. A well-presented business plan showcases your commitment and vision, instilling confidence in lenders.

Are Online Lenders a Viable Option, and How Do They Differ from Traditional Banks?

Evaluate the pros and cons of online lenders versus traditional banks. Online lenders often provide faster approvals and flexibility, while traditional banks may offer lower interest rates. Consider your business needs and preferences when choosing the right lending institution.

What Role Does a Comprehensive Business Plan Play in Loan Approval?

A comprehensive business plan is a key component of loan approval. It gives lenders insights into your business strategy, potential risks, and growth projections. Tailor your business plan to align with the specific requirements of the lender.

How Can Entrepreneurs Mitigate Risk and Increase Loan Approval Odds?

Identify potential risks associated with your business and develop strategies to mitigate them. Lenders appreciate proactive risk management measures, increasing credibility and improving loan approval odds.

What are the Common Mistakes to Avoid During the Small Business Loans Application Process?

Avoid common pitfalls, such as providing inaccurate information, neglecting due diligence, or applying for the wrong type of loan. Thoroughly review your application to eliminate errors that could lead to unnecessary delays or rejection.

How Can Entrepreneurs Showcase Business Stability and Viability to Lenders?

Demonstrate your business’s stability by showcasing consistent revenue, positive cash flow, and a solid customer base. Provide evidence of long-term viability, reassuring lenders about the soundness of their investment.

What Steps Should Business Owners Take If They Have Limited or No Credit History?

If your business has a limited credit history, explore alternative ways to showcase your creditworthiness. Offer personal guarantees, provide evidence of timely bill payments, or seek a co-signer to strengthen your loan application.

How Does Collateral Impact Small Business Loan Approval and Terms?

Collateral serves as security for lenders in case of default. Understand the types of collateral accepted and ensure you have sufficient assets to secure the loan. A strong collateral position can lead to more favourable loan terms.

What Are the Key Terms and Conditions Entrepreneurs Should Scrutinize in Loan Offers?

Thoroughly review loan offers, paying close attention to interest rates, repayment terms, fees, and any covenants. Negotiate terms that align with your business’s financial capabilities and long-term goals.

How Can Entrepreneurs Effectively Negotiate Loan Terms and Interest Rates?

Negotiation is a critical aspect of the loan process. Be prepared to discuss and justify your requested terms. Highlight your business’s strengths and demonstrate why the proposed terms are fair and reasonable.

What Post-Application Actions Should Entrepreneurs Take to Expedite Loan Approval?

After submitting your application, maintain open communication with the lender. Respond promptly to any additional requests for information and provide updates on your business’s progress. Proactive communication demonstrates commitment and expedites the approval process.

How Can Entrepreneurs Maintain a Positive Relationship with Lenders Throughout the Loan Process?

Nurture a positive relationship with lenders by informing them about your business’s performance. Provide regular updates, discuss any challenges, and demonstrate a commitment to transparency. A strong relationship can prove beneficial for future financial needs.

In conclusion, navigating the small business loan application process requires careful planning and strategic decision-making. By following these steps and considering key factors, entrepreneurs can position themselves for success and secure the funding needed to propel their businesses forward.

Leave a Reply