Table of Contents

When considering loan cost, understanding the impact of lowering your interest rate is crucial. Even a seemingly small decrease in your rate can translate to significant savings over the life of your loan. For instance, if you’re paying a 5% interest rate on a $200,000 mortgage over 30 years, reducing that rate to 4% could save you tens of thousands of dollars. Calculating the potential savings based on your specific loan amount and term is essential to grasp the true benefits of rate reduction. Utilizing online calculators or consulting with a financial advisor can help you determine your potential savings accurately.

Another aspect to consider is the effect of compounding interest. By lowering your interest rate, you save on the interest itself and the future interest payments that would have accumulated. This compounding effect can amplify your savings over time, further emphasizing the importance of securing a lower loan cost.

Can Making Extra Payments Really Reduce Your Loan Cost?

Making extra payments towards your loan principal is a powerful strategy to diminish your loan cost ratio. Even a modest additional payment each month can shave off years from your loan term and save you a significant amount in interest. For example, if you have a $300,000 mortgage with a 4% interest rate over 30 years, making just one extra monthly payment per year could shorten your loan term by several years and save you thousands in interest.

Moreover, by reducing the principal balance of your loan, you decrease the amount of interest accruing over time. This lowers your overall loan cost and accelerates your journey to debt-free homeownership. However, checking with your lender to ensure there are no prepayment penalties before implementing an extra payment strategy is essential.

Is It Time to Consider Refinancing Your Loan?

Refinancing your loan can be a strategic move to lower your loan cost and improve your financial situation. Refinancing can lead to substantial savings, especially when interest rates are lower than when you initially obtained your loan. By securing a new loan with a lower interest rate, you can reduce your monthly payments and the total amount of interest paid over the life of the loan.

Additionally, refinancing offers the opportunity to adjust the term of your loan. Opting for a shorter term can decrease your loan cost, although it may result in slightly higher monthly payments. However, the long-term savings in interest can outweigh the initial increase in monthly expenses. It’s crucial to weigh the pros and cons carefully and consider closing costs and how long you plan to stay in your home before deciding to refinance.

How Can Improving Your Credit Score Reduce Loan Costs?

Your credit score plays a significant role in determining the interest rate you qualify for on loans. A higher credit score typically translates to lower interest rates, directly impacting your loan cost. By improving your credit score, you can position yourself to secure more favourable loan terms, ultimately saving you money over the life of the loan.

One way to boost your credit score is by ensuring timely payments on existing debts and keeping your credit utilization ratio low. Reviewing your credit report regularly for errors and addressing any discrepancies can help improve your score over time. While building and maintaining good credit requires patience and discipline, long-term savings on loan costs make it worthwhile.

Are There Hidden Fees Adding to Your Loan Cost?

When assessing the total loan cost, looking beyond the interest rate and principal amount is essential. Hidden fees, such as origination fees, application fees, and closing costs, can significantly impact the overall cost of borrowing. These fees are often rolled into the loan amount, resulting in higher monthly payments and increased loan costs over time.

Before committing to a loan, carefully review the loan estimate provided by the lender, which outlines all associated fees and costs. Compare these fees across different lenders to ensure you get the best deal possible. Negotiating with lenders or seeking out loan programs with reduced fees can minimize the impact of hidden costs on your loan cost.

Can Choosing a Shorter Loan Term Save You Money?

Opting for a shorter loan term can lead to substantial savings in loan cost over time. While shorter terms typically come with higher monthly payments, they also result in lower total interest payments due to the reduced time frame for repayment. For example, a 15-year mortgage generally carries a lower interest rate than a 30-year mortgage, resulting in significant long-term savings.

Additionally, choosing a shorter loan term can help you build equity in your home more quickly, providing greater financial stability and flexibility. By paying off your loan sooner, you free up funds that can be allocated towards other financial goals, such as retirement savings or education expenses. It’s essential to carefully evaluate your budget and long-term financial objectives to determine the most suitable loan term for your needs.

Which Payoff Strategy Lowers Loan Cost Faster?

Various payoff strategies can help you quickly and efficiently reduce your loan cost. One popular approach is the debt avalanche method, which prioritizes high-interest debt while making minimum payments on all other debts. By tackling high-interest loans first, you minimize the interest accruing over time, leading to faster debt repayment and lower overall loan cost.

Another strategy is the debt snowball method, which focuses on paying off the smallest debts before moving on to larger ones. While this approach may not necessarily result in the lowest loan cost ratio, it can provide psychological momentum by achieving quick wins and motivating continued debt repayment. Ultimately, the most effective payoff strategy depends on your financial situation and goals.

Can Consolidating Loans Reduce Your Total Cost?

Consolidating multiple loans into a single, lower-interest loan can effectively reduce your total loan cost and simplify your debt repayment process. By combining debts such as credit card balances, personal loans, and student loans into a single loan with a lower interest rate, you can save money on interest and pay off your debt more quickly.

Additionally, loan consolidation can streamline your finances by consolidating multiple monthly payments into one, making managing your debt easier and avoiding missed payments. However, it’s essential to carefully compare the terms and fees associated with consolidation loans to ensure you’re getting a better deal overall. While consolidation can lower your loan cost, it’s only sometimes the right solution for everyone, so it’s crucial to weigh the pros and cons before proceeding.

Can You Prepay a Portion of Your Loan?

Prepaying a portion of your loan can effectively reduce your loan cost and accelerate your path to debt freedom. Whether through lump-sum payments or increased monthly installments, paying more than the minimum required can help you repay your loan sooner and save money on interest. By reducing the principal balance of your loan, you decrease the amount of interest accruing over time, leading to overall cost savings.

Additionally, prepaying your loan can provide peace of mind and financial security by reducing your debt burden. It’s essential to check with your lender to ensure there are no prepayment penalties and to determine the best prepayment strategy based on your financial situation and goals. Whether you choose to make occasional lump-sum payments or increase your monthly payments, every additional contribution helps lower your loan cost and brings you closer to financial freedom.

Where to Find Tools and Assistance for Reducing Loan Costs?

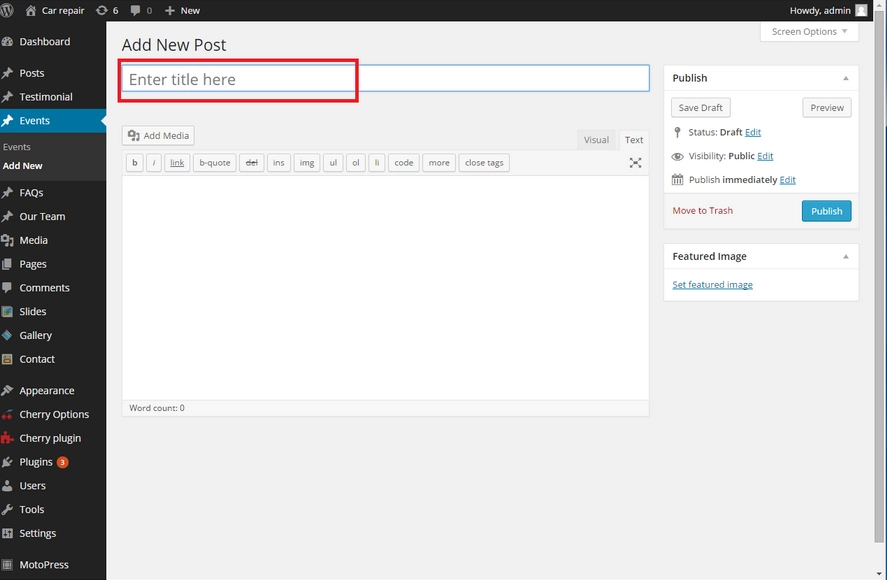

In today’s digital age, numerous resources and tools are available to help individuals manage their finances and reduce loan costs effectively. Online financial calculators can be valuable tools for estimating potential savings from actions such as refinancing, making extra payments, or choosing a shorter loan term. These calculators allow you to input various loan parameters and receive personalized projections of potential savings, empowering you to make informed financial decisions.

In conclusion, reducing loan costs requires careful planning, informed decision-making, and access to the right tools and resources. By leveraging online calculators, educational materials, financial consultations, and community support, individuals can develop effective strategies for minimizing loan costs and achieving greater financial security. Whether refinancing, making extra payments, or exploring debt consolidation options, taking proactive steps to reduce loan costs can lead to significant long-term savings and financial stability. For further assistance and guidance in managing your finances and reducing loan costs, visit Jointhegrave.com.

Leave a Reply