Table of Contents

In the dynamic landscape of the Indian insurance market, month to month car insurance plans will evolve significantly in 2024. These plans have become more versatile, catering to the diverse needs of car owners. The advent of Technology has played a pivotal role in this evolution, making the entire process more accessible and user-friendly.

How have Month-to-Month Car Insurance Plans Evolved in 2024?

Month to month car insurance plans have evolved to offer greater flexibility and customization. In 2024, insurers recognize the varied needs of customers and provide tailored solutions. This evolution includes incorporating advanced technologies and streamlining the application and claims processes. The emergence of telematics has allowed insurers to assess risk more accurately, leading to personalized premium calculations. The evolution also extends to the inclusivity of coverage, addressing a broader spectrum of potential risks.

The convenience of one-month plans allows car owners to adapt to changing circumstances without being tied down by long-term commitments. This flexibility has become a cornerstone in the evolution of month-to-month car insurance Plans in 2024.

What are the Key Features to Look for in 2024’s Car Insurance Plans?

In 2024, monthly auto insurance plans have many features that cater to the modern-day car owner’s demands. Comprehensive coverage, including protection against natural calamities, theft, and third-party liabilities, is fundamental. Moreover, insurers are now focusing on providing additional benefits such as roadside assistance, zero depreciation, and coverage for accessories.

The digitization of the insurance process has streamlined documentation and communication. Advanced customer support systems and user-friendly mobile applications enhance the overall customer experience. Car owners should prioritize plans that offer essential coverage and provide a seamless and enriching interaction throughout the policy term.

How do the Premiums of Different Month-to-Month Plans Compare This Year?

One-month car insurance plans in 2024 present a varied premium landscape influenced by factors like the type of coverage, vehicle model, and the policyholder’s driving history. The competitive market has led to insurers offering competitive pricing to attract customers. Car owners must compare premiums across different plans to find the right balance between affordability and coverage.

Insurers may offer discounts or personalized rates based on telematics data, emphasizing safe driving habits. Comparing premiums allows consumers to make informed decisions, ensuring they get the best value for their investment in month-to-month car insurance plans.

What are the Customer Reviews and Ratings for 2024’s Insurance Options?

Customer reviews and ratings provide valuable insights into the real-world experiences of policyholders. In 2024, prospective buyers can benefit from online platforms and social media to gauge the reputation of one-month car insurance plans. Positive reviews often highlight efficient claims processing, excellent customer service, and transparent communication.

Conversely, negative reviews may draw attention to claim denials, delays, or hidden charges. Analyzing customer feedback empowers car owners to make informed decisions, choosing insurers with a track record of customer satisfaction.

How Can You Customize Month to Month Plans to Suit Your Needs in 2024?

Customization is a key feature of month to month auto insurance plans 2024, allowing policyholders to tailor coverage to their specific requirements. Insurers offer add-ons that cater to individual needs, such as coverage for personal belongings inside the car or reimbursement for a rental vehicle during repairs.

Car owners should carefully assess their needs and lifestyle to determine the most relevant add-ons. This personalized approach ensures the insurance plan aligns seamlessly with the policyholder’s expectations and requirements.

What are the Emerging Trends in the Month to Month Car Insurance Plans?

The year 2024 witnesses several emerging trends in the month to month car insurance plans. One notable trend is integrating artificial intelligence (AI) and machine learning in risk assessment. Insurers leverage data analytics to evaluate driver behaviour, allowing for more accurate premium calculations and risk predictions.

Another trend is the emphasis on eco-friendly practices, with insurers offering incentives or discounts for environmentally conscious driving habits. Staying abreast of these emerging trends enables car owners to choose insurers that align with their values and preferences.

How has Technology Impacted the Accessibility of Insurance Options in 2024?

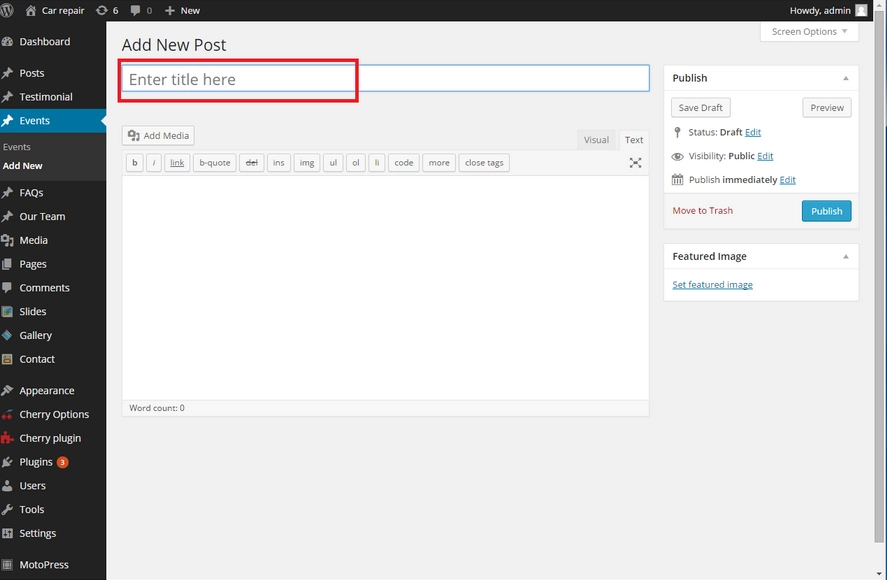

Technology has revolutionized the accessibility of monthly auto insurance plans in 2024. The digitization of the application process has made it faster and more convenient for policyholders. Mobile apps enable instant policy renewal, claims processing, and communication with customer support.

Moreover, integrating chatbots and virtual assistants has enhanced customer interaction, providing quick responses to queries. The tech-driven accessibility ensures a hassle-free experience for car owners seeking month-to-month insurance options.

What are the Exclusive Benefits Offered by Top Month-to-Month Plans This Year?

Top one-month car insurance plans in 2024 offer exclusive benefits that set them apart in the competitive market. Enhanced roadside assistance, cashless claim settlements, and access to a wide network of garages are some of the exclusive perks. Some insurers also provide loyalty rewards, encouraging long-term associations with customers.

Policyholders should carefully review the exclusive benefits offered by different plans to identify the ones that align with their priorities and enhance the overall coverage experience.

How Can You Navigate and Understand the Policy Terms in 2024?

Understanding month-to-month car insurance’s intricate terms and conditions is vital for making informed decisions. Policyholders should pay attention to coverage limits, exclusions, and claim procedures. Many insurers now offer user-friendly documentation and provide explanations in simple language.

Utilizing online resources and seeking clarification from customer support ensures that policyholders clearly understand the policy terms. This transparency fosters a trusting relationship between the insurer and the insured.

What are the Hidden Costs to Watch Out for When Considering Car Insurance?

While assessing one-month car insurance plans, being vigilant about potential hidden costs is crucial. Some policies may have deductibles, which are out-of-pocket expenses the policyholder must pay before the insurance coverage kicks in. Additionally, certain add-ons or coverage extensions may come with extra charges.

Policyholders should carefully read the fine print and ask insurers about any potential hidden costs to avoid unexpected financial implications. Awareness of these costs ensures a more accurate evaluation of the overall affordability of the insurance plan.

In conclusion, India’s landscape of month to month car insurance plans has evolved significantly in 2024. The emphasis on customization, technological advancements, and exclusive benefits provides car owners with diverse options. Before finalizing a plan, it’s crucial to compare premiums, read customer reviews, and understand the policy terms to make an informed decision. Stay protected and enjoy the benefits of tailored coverage with the right month-to-month car insurance plans in 2024.

Here are the India’s Top Month to Month Insurance Companies:

Acko General Insurance (https://www.acko.com/car-insurance/temporary-car-insurance/)

Digit General Insurance (https://www.godigit.com/motor-insurance/car-insurance)

TATA AIG General Insurance (https://www.tataaig.com/motor-insurance/car-insurance)

For more information and to explore the best month to month car insurance plans in 2024, visit Jointhegrave.com.

Leave a Reply