Table of Contents

Navigating the legal landscape for car insurance claims can be complex, and finding the right lawyer is crucial for a successful resolution. To ensure you choose a competent professional, consider the following criteria and steps.

What Criteria Should I Use to Evaluate the Competency of a Lawyer for Car Insurance Claims Near Me?

When assessing a lawyer’s competence for handling car insurance claims, focus on specific attributes and qualifications. Look for attorneys who possess extensive experience in insurance law, particularly in the realm of car insurance claims. Consider their track record, success rates, and the complexity of cases they have handled. A competent lawyer should demonstrate a deep understanding of local laws and regulations related to car insurance claims.

It’s essential to evaluate their communication skills, as clear and effective communication is crucial in legal matters. Additionally, verify their willingness to explain legal concepts in a way that you can understand, fostering a transparent attorney-client relationship.

Remember to check for any disciplinary actions or malpractice claims against the lawyer, ensuring a clean professional record.

Where Can I Conduct Local Research to Identify Highly Competent Lawyers for Car Insurance Claims?

Local research is key to identifying competent lawyers for car insurance claims. Begin by consulting friends, family, or colleagues who may have had similar legal needs. Local bar associations and legal directories are valuable resources, providing a list of qualified attorneys in your area. Online legal platforms and forums can also offer insights from individuals who have previously engaged the services of car insurance claim lawyers.

Local courthouses and legal aid organizations may provide recommendations or referrals, offering a more personalized approach to your search.

Are There Any Online Reviews or Ratings That Can Help Assess a Lawyer’s Competence in Car Insurance Claims?

Online reviews and ratings play a significant role in assessing a lawyer’s competence. Platforms like Yelp, Google Reviews, and legal-specific sites can provide valuable insights into the experiences of previous clients. Look for patterns in reviews that highlight a lawyer’s strengths and potential areas of improvement. Be cautious not to rely solely on ratings; read detailed reviews to understand specific aspects of their competence, such as communication, negotiation skills, and case outcomes.

What Qualifications and Credentials Should I Look for in a Lawyer Handling Car Insurance Claims?

When selecting a lawyer for car insurance claims, consider their qualifications and credentials. Look for professionals who have completed relevant legal education and training. A lawyer with a specialization or certification in insurance law demonstrates a commitment to staying current in this specific field.

Verify their licensure and ensure they are in good standing with the state bar association. Some lawyers may also belong to professional organizations related to insurance law, showcasing their dedication to continuous professional development.

How Can I Verify a Lawyer’s Track Record of Success in Handling Car Insurance Claim Cases?

Verifying a lawyer’s track record is crucial to assessing their competence. Request information on their past cases related to car insurance claims. A seasoned lawyer will willingly share details of successful cases, including favorable settlements or verdicts. Pay attention to the complexity of cases they’ve handled and whether they have experience dealing with insurance companies.

Consider asking for client references or testimonials to gain a better understanding of the lawyer’s reputation and effectiveness in navigating car insurance claim disputes.

Are There Local Bar Associations or Legal Directories I Can Consult to Find Competent Lawyers?

Local bar associations and legal directories are valuable resources for finding competent lawyers. These organizations often maintain directories of attorneys, categorizing them based on their practice areas. Contact your local bar association or explore legal directories online to compile a list of potential candidates.

These directories typically provide brief profiles of lawyers, making it easier for you to identify those with expertise in car insurance claims. Additionally, some directories may include peer reviews or endorsements, offering further insights into a lawyer’s reputation within the legal community.

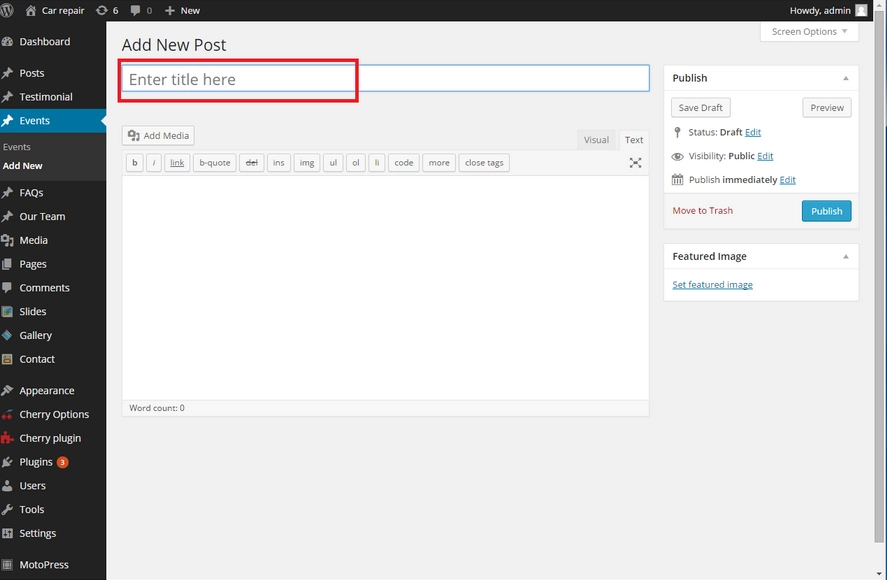

What Questions Should I Ask During the Initial Consultation to Assess a Lawyer’s Competency?

The initial consultation is a crucial opportunity to assess a lawyer’s competency. Prepare a list of relevant questions to gain insight into their experience and approach to handling car insurance claims. Ask about their specific experience in similar cases, the strategies they employ, and their success rates. Inquire about their understanding of local laws and regulations governing car insurance claims.

Additionally, discuss their communication style and how they plan to keep you informed throughout the legal process. Assess their willingness to provide clear explanations and address any concerns you may have.

Are Specialized Skills or Expertise Necessary for Lawyers Dealing Specifically with Car Insurance Claims?

Specialized skills and expertise are highly beneficial when dealing with car insurance claims. Lawyers specializing in this area possess an in-depth understanding of the nuances of insurance law, allowing them to navigate complex policies and negotiations effectively.

Look for lawyers with specific experience in handling cases related to car accidents, personal injury, and insurance disputes. Specialized knowledge of medical and financial aspects related to car accidents is also advantageous.

How Do I Determine the Reputation of a Lawyer for Car Insurance Claims in the Local Legal Community?

Determining a lawyer’s reputation within the local legal community is crucial. Seek feedback from other legal professionals, such as attorneys or judges, who may have insights into the lawyer’s standing. Attend local legal events or seminars where you can network and gather opinions on reputable lawyers for insurance claims.

Explore online forums or communities where legal professionals discuss their experiences and share recommendations. A lawyer with a positive reputation in the local legal community is likely to have established trust and credibility among peers.

What Are Some Warning Signs That Indicate a Lawyer May Not Be Competent in Handling Car Insurance Claims?

Recognizing warning signs is essential to avoid hiring a lawyer who may not be competent in handling car insurance claims. Be cautious if a lawyer avoids providing clear answers to your questions, lacks specific experience in car insurance claims, or has a history of disciplinary actions. Consider the clarity and transparency of their communication, as effective communication is vital in legal proceedings.

Additionally, be wary of lawyers who make unrealistic promises or guarantees regarding the outcome of your case. Lack of responsiveness, disorganization, or a general lack of professionalism may also indicate potential competency issues.

General FAQ’s:

Do I Really Need a Lawyer for My Car Insurance Claim, or Can I Handle it on My Own?

While you have the option to handle a insurance claim on your own, engaging a lawyer can significantly enhance your chances of a favorable outcome. A lawyer brings expertise in navigating complex legal processes, negotiating with insurance companies, and maximizing your compensation. Especially in cases involving disputes or significant damages, legal representation can be invaluable.

What Is the Typical Cost Structure for Hiring a Lawyer for Insurance Claims?

Legal fees for car insurance claims can vary, and it’s essential to discuss the cost structure with potential lawyers. Many attorneys in this field work on a contingency fee basis, meaning they only get paid if you receive compensation. Clarify the percentage they will take from the settlement and any additional costs or fees. Some lawyers may offer free initial consultations to discuss your case and fee arrangements.

How Long Does It Usually Take to Resolve a Car Insurance Claim with Legal Representation?

The time frame for resolving a insurance claim with legal representation depends on various factors, including the complexity of the case, the cooperation of involved parties, and the legal processes involved. A straightforward case may be resolved more quickly, while complex disputes or negotiations could extend the timeline. Your lawyer should provide a realistic estimate based on the specific details of your case.

What Should I Bring or Prepare for the Initial Consultation with a Lawyer?

For the initial consultation with a lawyer, come prepared with essential documents related to your car insurance claim. Bring copies of the accident report, photographs of the accident scene and damages, medical records, correspondence with the insurance company, and any other relevant documents. Additionally, be ready to provide a detailed account of the events leading to the claim and any communication with the insurance company.

Can I Switch Lawyers if I’m Not Satisfied with the One I Initially Hired for My Car Insurance Claim?

Yes, you have the right to switch lawyers if you are not satisfied with your initial choice. However, it’s crucial to handle the transition smoothly. Notify your current lawyer in writing, expressing your decision to terminate their services. Ensure that any fees owed are settled, and request copies of your case files. Before hiring a new lawyer, discuss the reasons for changing representation and ensure that the new lawyer is willing to take over your case seamlessly.

Leave a Reply