Imagine finding yourself or a loved one in the midst of a medical emergency, where every second counts. The last thing you need is the stress of financial burdens hindering your ability to receive the urgent care required. Thankfully, loan for medical emergency exists to offer a lifeline during these difficult times, providing the necessary funds to overcome financial obstacles and prioritize your health. In this article, we’ll delve into the vital considerations that will empower you to make an informed decision when opting for a medical emergency loan.

Understanding the Need for a Medical Emergency Loan

When life throws a curveball, such as unexpected medical expenses, a loan for medical emergency can be a beacon of hope. It’s crucial to grasp the significance of your situation and acknowledge that seeking financial assistance is not a sign of weakness but a practical solution to ensure you receive the vital healthcare you need.

Researching and Comparing Lenders

Finding the right lender for your medical emergency loan is akin to finding a trustworthy ally. Take the time to research and compare different lenders, both online and traditional financial institutions, that specialize in offering assistance during such critical moments. Seek out genuine customer reviews, consult healthcare professionals, or consult your friends and family who may have navigated similar circumstances. Gathering insights from those who have walked the path before can be immensely valuable in finding a lender that aligns with your needs.

Assessing Loan Eligibility

Preparing yourself before diving into the loan application process is essential for a smoother experience. Different lenders may have specific eligibility requirements, such as credit scores, employment history, or income levels. By understanding these prerequisites in advance, you can determine if you meet the criteria and save yourself from unnecessary disappointments. Knowing your eligibility status empowers you to approach the loan application process confidently.

Loan Amount and Repayment Terms

While it may be tempting to borrow an excessive amount to cover all potential costs, it’s wise to exercise restraint and borrow just what is necessary. This approach minimizes the financial strain on your future self. Also, meticulously consider the repayment terms offered by different lenders, including interest rates, loan tenure, and monthly instalments. Striking a balance between loan amount and repayment terms ensures you can manage your finances responsibly while effectively meeting your medical needs.

Hidden Charges and Fees

In pursuit of financial assistance, watching out for any and all hidden charges or fees that might sneak up on you is crucial. These additional costs, such as processing fees, prepayment penalties, late repayment fees, or origination fees, can significantly impact your overall repayment amount. To avoid unpleasant surprises, choose a lender working with transparency and minimal hidden charges, providing you with peace of mind during an already challenging period.

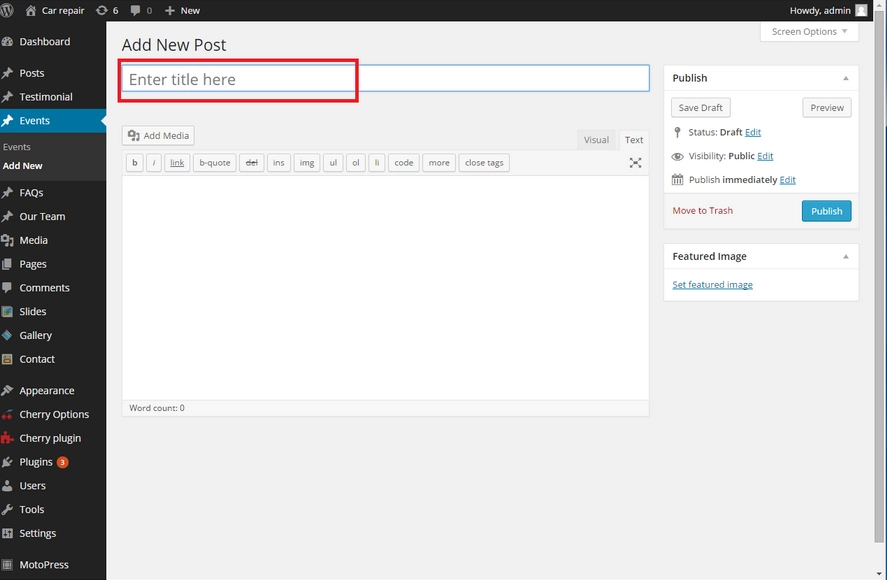

Instant Personal Loan Online

In this modern era, technology has revolutionized the lending landscape, making it possible to apply for your instant personal loan online. These loans offer the convenience of quick access to funds, eliminating the hassle of extensive paperwork and lengthy approval processes. Embrace the advantages of the digital realm, but exercise caution by selecting reputable online platforms that prioritize the security of your personal and financial information.

Credit Score Impact

Applying for a medical emergency loan may temporarily affect your credit score. As lenders typically conduct credit checks during the loan application process, your score may experience a minor dip. However, making timely repayments on your loan can positively impact your creditworthiness in the long run. If you notice you have a less-than-ideal credit score, consider lenders who specialize in assisting individuals with similar credit histories.

Conclusion:

During a medical emergency, the last thing you need is the burden of financial worries hindering your path to recovery. Fortunately, medical emergency loans can be a lifeline, ensuring that you can focus on receiving the necessary care without compromising your financial well-being. By considering the factors discussed in this article, such as loan eligibility, repayment terms, hidden charges, and the impact on your credit score, you can make an empowered decision that places your health as the top priority. Remember, your well-being is priceless, and with the right loan option, you can navigate through the storm and emerge stronger on the other side.

Also Read: Personal Loan with Low CIBIL Score

Leave a Reply