In the bustling streets of India, dreams are big, and aspirations are even bigger. However, not everyone is blessed with a high credit score, and when it comes to applying for personal loans, this can pose a serious challenge. A low CIBIL score can significantly hinder one’s chances of securing a loan, often leaving them feeling frustrated and hopeless. Yet, there’s a silver lining to this seemingly bleak situation. This article aims to provide valuable insights on how to secure a personal loan for low CIBIL score. So, let’s dive right in!

Understanding the Implications of a Low CIBIL Score

A CIBIL score is a three-digit number that represents an individual’s creditworthiness. The lower the score, the riskier you appear to lenders. So, what’s the deal with having a low CIBIL score?

- Reasons for a Low Score: Common causes include late payments, maxed-out credit cards, and defaulted loans.

- Impacts on Loan Approvals: Lenders may hesitate to approve loans for those with low scores due to the perceived risk.

Strategies to Secure Personal Loans with a Low CIBIL Score

All hope is not lost. Even with a low CIBIL score, there are ways to increase your chances of loan approval:

- Opt for NBFCs or P2P Lenders

These lenders may be more lenient and offer personal loan for low CIBIL score, albeit at potentially higher interest rates.

- Show Proof of Stable Income

Demonstrating a consistent income can reassure lenders of your ability to repay.

- Offer a Guarantor or Collateral

Backing your loan with collateral or having someone vouch for you can tilt the balance in your favour.

Improve Your CIBIL Score

Before delving deep into loan applications, it’s worth taking a moment to explore ways to uplift your score:

- Check for Errors in Your Credit Report: A simple mistake could be dragging your score down. Rectifying it can make a difference.

- Repay Outstanding Debts: Make it a priority to clear any lingering debts. This not only boosts your score but also paints you as a responsible borrower.

- Avoid Multiple Loan Enquiries: Each time you apply for a loan, an enquiry is made. Multiple enquiries can negatively impact your score.

How Interest Rates Are Calculated

Embarking on the journey of securing a personal loan can often be overwhelming, especially when you are dealing with a low CIBIL score. One of the most critical aspects you’ll encounter is understanding how interest rates are calculated. The rate at which you borrow can make a significant difference to your repayments, and being well-informed can save you from unforeseen financial burdens.

Factors Affecting Interest Rates

When lenders decide the interest rate, several elements come into play. Firstly, the principal loan amount, or how much you wish to borrow, is a determinant. Then, the loan tenure or the period over which you intend to repay the loan weighs in. Furthermore, individual lender policies and market conditions contribute to rate setting. And, of course, your CIBIL score acts as an essential influencer. A higher score might fetch you a better rate, while a lower score might mean higher interest rates.

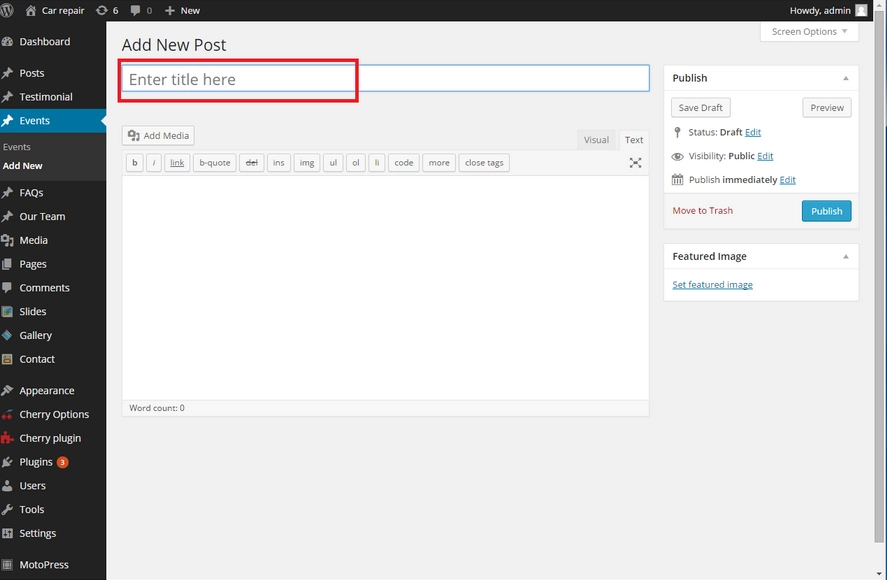

Benefits of Using a Calculator

In this digital age, tools like the personal loan interest calculator offer borrowers a unique advantage. By merely inputting some basic information, you can get an estimate of your monthly instalments. This not only offers clarity but also aids in crafting a suitable budget, ensuring you remain financially sound throughout the loan period.

The Role of Employment in Securing a Personal Loan

In the financial world, trust plays a pivotal role, especially when lending money. Lenders, whether traditional options or newer financial tech platforms, always seek reassurance. Apart from the CIBIL score, one significant marker of an individual’s creditworthiness is their employment status.

Steady Employment Equals Trust

A consistent job, especially one held for several years, indicates stability. Lenders often view applicants with steady employment as being more reliable, assuming they’ll have a continuous flow of income to pay back the loan.

Self-Employed or Freelancer

The burgeoning gig economy means many of us aren’t in traditional 9-5 roles. While it’s a sign of an evolving work culture, it can sometimes pose challenges when applying for loans. However, presenting clear records of your income, like bank statements or tax returns, can go a long way in ensuring lenders of your repayment capacity.

Changing Jobs Frequently

In contrast, frequently switching jobs may raise eyebrows. Lenders might perceive it as a sign of instability, potentially affecting the loan approval process or the interest rate offered.

Conclusion

Securing a personal loan for low CIBIL score may seem like a daunting task. Yet, with the right approach and knowledge, it’s entirely possible. Remember, your current financial situation is not set in stone. By taking proactive steps and utilising tools like a personal loan interest calculator, you can secure that dream loan and achieve your financial aspirations.

Leave a Reply