Table of Contents

In the ever-evolving landscape of small businesses, financial projections and forecasting are pivotal in navigating the path to success. Understanding the nuances of managing these aspects is crucial for making informed decisions and ensuring the long-term viability of your venture. Let’s explore the top tips for effective management.

Why are Financial Projections & Forecasting Important for Small Businesses?

Financial projections and forecasting are the backbone of strategic planning for small businesses. Small Business Ideas often start as dreams, and turning them into reality requires a clear financial roadmap. Companies can anticipate potential challenges and capitalise on opportunities by forecasting future revenues, expenses, and profits. This process not only aids in securing funding but also establishes a framework for day-to-day financial decisions.

To truly thrive, businesses must set realistic goals and align their actions with financial projections. Reliable financial forecasting provides a roadmap that helps small business owners navigate the competitive landscape and adapt to market changes, ensuring longevity.

How to Gather Reliable Data for Accurate Projections & Forecasting?

Accurate financial projections hinge on the data quality used in the forecasting process. Top Small Business Ideas emerge from thoroughly understanding market trends, customer behavior, and industry dynamics. Gathering reliable data involves leveraging various sources, including market research, historical financial records, and industry reports.

Collaborating with industry experts and utilizing advanced analytics tools can enhance the accuracy of your data. By staying abreast of market developments and consumer preferences, you can refine your projections, making them more reflective of the dynamic business environment. Data accuracy is fundamental in building a robust foundation for your financial projections.

What are the Key Elements to Include in Your Financial Projections?

Creating comprehensive financial projections involves considering various key elements to provide a holistic view of your business’s financial health. Essential components include revenue forecasts, expense estimates, cash flow projections, and profit margins. Small Business Ideas for Women 2024 needs to be rooted in a thorough analysis of these elements to empower women entrepreneurs to make informed decisions.

Incorporating realistic growth rates and factoring in seasonality or market fluctuations contributes to the accuracy of your projections. Additionally, understanding your break-even point and setting realistic timelines for achieving financial milestones ensures a well-rounded economic forecast that is a reliable guide for business growth.

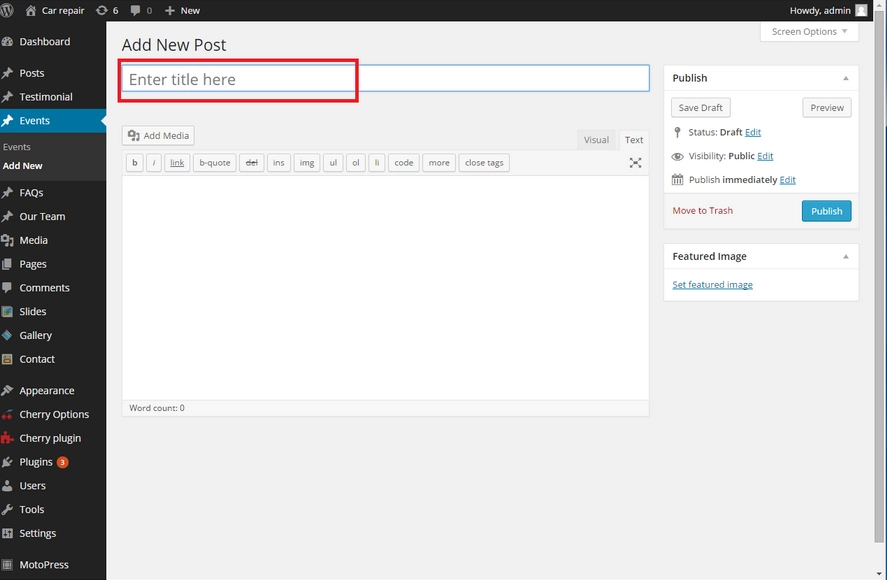

They are building Your Forecast: Which Tools & Resources Can Help?

Building a robust financial forecast involves leveraging tools and resources that streamline the process and enhance accuracy. Accounting software, financial modelling tools, and industry-specific resources can significantly simplify forecasting. Small Business Ideas for Students often require user-friendly tools that cater to their unique needs, fostering a learning environment.

These tools automate complex calculations and offer insights into financial trends, allowing students and aspiring entrepreneurs to make informed decisions. Incorporating technology into the forecasting process saves time and minimizes the margin of error, providing a solid foundation for financial planning.

Beyond Numbers: How to Make Your Projections & Forecasts Actionable?

While numbers are the backbone of financial projections, making them actionable is equally crucial. Successful businesses go beyond numerical analysis and integrate qualitative insights into their forecasting process. Small Business Ideas that resonate with the target audience and address genuine needs have a higher chance of turning projections into reality.

Understanding customer feedback, market trends, and emerging opportunities enables businesses to refine their strategies dynamically. Integrating customer-centric approaches and adapting forecasts based on real-time feedback ensures that your projections align with the ever-changing landscape of consumer preferences.

Anticipating the Unexpected: How to Factor in Risks & Uncertainties?

In the volatile world of business, anticipating and mitigating risks is paramount. Including a risk assessment in your financial projections prepares your business for unforeseen challenges. Small Business Ideas for Students often require a risk-aware approach, teaching them the importance of contingency planning.

Identifying potential risks, such as economic downturns, supply chain disruptions, or regulatory changes, allows businesses to develop strategies for resilience. By factoring in uncertainties, your financial projections become more robust and adaptable, providing a safety net for your business in the face of unexpected challenges.

Staying on Track: How to Monitor & Update Your Projections & Forecasts?

Financial projections are not static; they require continuous monitoring and adjustment. Regularly comparing actual performance against projected figures allows businesses to identify discrepancies and adjust strategies accordingly. Top Small Business Ideas are built on agility, responding promptly to market shifts and consumer demands.

Implementing key performance indicators (KPIs) and utilizing financial dashboards facilitates real-time monitoring. Regularly updating your projections based on actual data ensures that your business remains on course and can seize emerging opportunities, fostering sustained growth.

Common Mistakes to Avoid When Managing Financial Projections & Forecasting?

Despite the importance of financial projections, businesses often fall prey to common mistakes that can jeopardize their accuracy. One prevalent error is underestimating expenses or overestimating revenues, leading to misguided decision-making. Small Business Ideas should be grounded in realistic financial expectations to avoid inflated projections.

Another common pitfall is neglecting to consider external factors such as economic trends, regulatory changes, or technological advancements. A holistic approach that accounts for both internal and external influences is essential for creating accurate and reliable financial projections.

Seeking Expert Help: When Should You Consider Hiring a Financial Professional?

While small business owners wear many hats, there comes a point where seeking expert assistance becomes imperative. Engaging a financial professional can provide valuable insights, especially in complex economic scenarios. Small Business Ideas for Women 2024 often benefits from financial professionals’ specialized knowledge and experience, ensuring a solid financial foundation.

A financial professional can assist in refining financial projections, optimizing cash flow management, and offering strategic advice for sustainable growth. Knowing when to delegate financial tasks to experts is crucial in ensuring the accuracy and effectiveness of your business projections.

The Future is Now: How Can Advanced Analytics Improve Your Projections & Forecasting?

Incorporating advanced analytics into your financial projections can elevate your forecasting capabilities in the era of technological advancements. Analyzing big data, utilizing machine learning algorithms, and leveraging predictive analytics can provide deeper insights into market trends. Top Small Business Ideas leverage cutting-edge technologies to gain a competitive edge in the market.

By harnessing the power of advanced analytics, businesses can identify patterns, detect emerging trends, and make data-driven decisions. This forward-looking approach enables enterprises to stay ahead of the curve and position themselves strategically in the market.

In conclusion, mastering the art of managing small business financial projections and forecasting is essential for sustainable growth. By understanding the importance of gathering reliable data, incorporating key elements, utilizing tools, making projections actionable, accounting for risks, staying vigilant, avoiding common mistakes, seeking expert help when needed, and embracing advanced analytics, businesses can successfully navigate the complex financial landscape. For further insights and guidance on optimizing your financial strategies, visit Jointhegrave.com.

Leave a Reply