Table of Contents

Riding the trails on your dirt bike is an exhilarating experience, but ensuring comprehensive insurance coverage is paramount for your peace of mind. Best dirt bike insurance is not a one-size-fits-all solution; it’s about finding a policy that caters to your needs. Understanding the key features that define comprehensive dirt bike insurance coverage is the first step in securing your off-road adventures.

What Key Features Define Comprehensive Dirt Bike Insurance Coverage?

Comprehensive dirt bike insurance goes beyond the basics, offering a holistic approach to protection. Look for policies that cover accidents, theft, vandalism, and damage caused by natural elements. Adequate liability coverage is crucial, ensuring you’re financially safeguarded in case of third-party injuries or property damage during your rides. Additionally, seek policies with coverage for aftermarket modifications, recognizing the unique enhancements riders often make to their dirt bikes.

When researching comprehensive coverage, consider the deductible amounts and the extent of coverage for medical payments. Insurance for dirt bikes should address the nuances of off-road riding, providing a safety net that extends beyond what standard plans offer.

Where Can You Find Tailored Coverage Plans for Your Dirt Bike?

Tailoring your insurance plan to fit your dirt bike and riding habits is essential. Leading insurance providers understand the diverse needs of off-road enthusiasts. Look for insurers that specialize in motorcycle coverage and offer customizable plans. Dirt bike insurance State Farm and other reputable providers often have agents who can guide you through tailoring your coverage to ensure it aligns with your specific requirements.

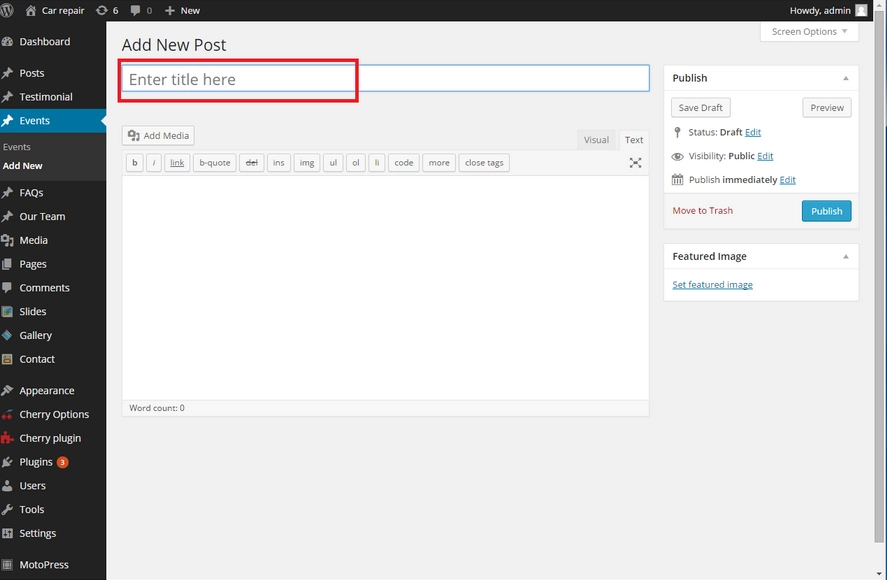

Explore policy options that allow you to adjust coverage limits, deductibles, and additional features based on your preferences. Utilize online platforms provided by insurers, enabling you to input your requirements and receive personalized quotes tailored to your dirt bike and riding style.

Which Providers Offer the Widest Range of Protection for Off-Road Enthusiasts?

When seeking the broadest protection for your dirt bike, turn to insurance providers renowned for their commitment to off-road enthusiasts. Companies like State Farm, Progressive, and Allstate have established themselves as motorcycle insurance leaders, including comprehensive dirt bike coverage. These providers often understand the unique risks associated with off-road riding, allowing them to offer tailored solutions.

Before finalizing your decision, compare the coverage options, customer reviews, and claim processes of various providers. Choose a company that covers the basics and provides additional protections specific to dirt bike riders, such as coverage for off-road accessories and gear.

How Does Comprehensive Dirt Bike Insurance Differ from Basic Plans?

Distinguishing between comprehensive dirt bike insurance and basic plans is crucial for riders seeking comprehensive coverage. While basic plans typically cover the essential liabilities and damages resulting from accidents, comprehensive coverage extends its reach to protect against a broader range of risks.

Dirt bike insurance coverage often includes coverage for theft, vandalism, fire, and natural disasters. Additionally, it may cover the replacement cost of aftermarket modifications, ensuring that your unique enhancements are safeguarded. Understanding these differences empowers riders to make informed decisions about the level of protection they need for their off-road adventures.

Where Should You Turn for Affordable Premiums without Sacrificing Coverage?

Affordability is a significant factor when choosing comprehensive dirt bike insurance. Riders must strike a balance between cost and coverage to ensure they receive adequate protection without breaking the bank. While premium rates can vary among insurers, some companies offer competitive rates for comprehensive coverage.

Researching and obtaining quotes from multiple providers is essential in finding the most affordable yet comprehensive insurance for your dirt bike. Additionally, inquire about discounts that may be available, such as multi-policy discounts or safety course discounts, to reduce your premium costs further.

What Add-Ons Enhance the Comprehensive Nature of Dirt Bike Insurance?

Enhancing your dirt bike insurance’s comprehensive nature involves exploring add-on options beyond the standard coverage. Consider additional protections like roadside assistance, which can be invaluable in off-road situations where traditional towing services may not reach. Accessory coverage is another crucial add-on, ensuring that your aftermarket modifications, riding gear, and accessories are fully protected.

When customizing your policy, discuss with your insurer the availability of specific add-ons that align with your off-road needs. Comprehensive dirt bike insurance isn’t just about covering the bike itself; it’s about safeguarding every aspect of your riding experience.

Where to Seek Expert Advice on Customizing Your Dirt Bike Insurance Plan?

Navigating the customization of your dirt bike insurance plan may require expert advice. Insurance agents specializing in motorcycle coverage, especially for off-road enthusiasts, can offer valuable insights into tailoring your policy to match your unique needs. Dirt bike insurance coverage often involves nuances that standard insurance agents may not fully grasp, making it crucial to seek guidance from those with expertise in the field.

Reputable insurance companies often have dedicated agents or service representatives knowledgeable about dirt bike insurance. Please use their expertise to ensure your policy is comprehensive, addressing the risks associated with off-road riding.

Which Insurers Have a Proven Track Record in Delivering Comprehensive Coverage?

A proven track record strongly indicates an insurer’s reliability in delivering comprehensive dirt bike insurance coverage. Research the history and reputation of potential insurers to identify those committed to protecting off-road enthusiasts. Reading customer reviews, checking claim settlement records, and assessing the overall satisfaction of policyholders can provide valuable insights into an insurer’s performance.

Well-established companies like State Farm, Geico, and Progressive have a history of catering to the unique needs of motorcycle riders, including comprehensive coverage for dirt bikes. Choosing an insurer with a proven track record ensures you can trust their commitment to providing the protection you need.

How to Assess Your Riding Needs to Determine the Right Comprehensive Plan?

Assessing your riding needs is crucial in determining the right comprehensive dirt bike insurance plan. Consider factors such as the frequency of your off-road adventures, the terrain you typically ride on, and the level of customization your dirt bike has undergone. Your riding habits and the risks associated with your chosen trails should inform the coverage limits and add-ons you select.

Engage in a comprehensive self-assessment or consult with experienced riders to identify potential risks and coverage gaps. This proactive approach ensures that your insurance plan aligns with your unique off-road experiences, providing peace of mind during every ride.

Where Can You Access Online Tools to Compare and Choose the Best Coverage?

The convenience of online tools has revolutionized the process of comparing and choosing the best comprehensive dirt bike insurance coverage. Reputable insurers often provide user-friendly online platforms where riders can instantly input their information and receive customized quotes. Take advantage of these tools to compare coverage options, premiums, and additional features from multiple providers.

Ensure that the online tools offered by insurers are secure and provide accurate quotes based on your specific dirt bike and riding details. Utilizing these tools allows you to streamline the insurance shopping process, making it easier to find coverage that perfectly aligns with your off-road adventures.

In conclusion, securing the best dirt bike insurance involves thoughtful consideration of key features, tailored coverage plans, and reputable providers. By understanding the nuances of comprehensive coverage, riders can protect themselves against many risks associated with off-road adventures. As you search for the ideal insurance plan, remember to assess your riding needs, seek expert advice, and utilize online tools for a comprehensive and tailored insurance solution.

For more information and assistance in finding the right coverage for your dirt bike, visit Jointhegrave.com, where our experts are dedicated to helping riders make informed decisions about their insurance needs. Jointhegrave.com is your trusted partner in navigating the world of off-road insurance, ensuring you can focus on the thrill of the ride with confidence.

Leave a Reply