- Advertisement -

TOP REVIEWS

In the ever-evolving cybersecurity landscape, enterprise data security is paramount for organizations worldwide. ...

In the realm of human existence, specific individuals transcend the ordinary ...

The digital age has revolutionized how we store and access data. ...

- Advertisement -

LATEST BLOG ARTICLES

In the ever-evolving cybersecurity landscape, enterprise data security is paramount ...

In the realm of human existence, specific individuals ...

The digital age has revolutionized how we store ...

How Do I Know If Suing My Insurance ...

If you’re a proud owner of a Chevy EV ...

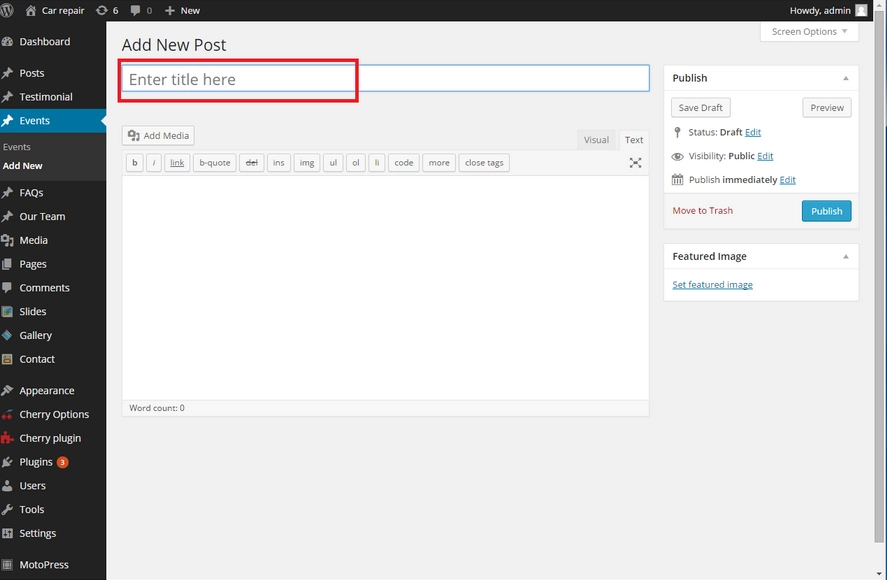

Placeholder posts can be a pesky nuisance, cluttering ...

A time for golden oldies to trade in ...

When considering loan cost, understanding the impact of lowering ...